Budgeting in a modern world

Thirty years after its debut, Microsoft Excel is still the preferred tool for budgeting and planning projects. However, its popularity is declining, due in most part to the rise of technology and subscription-based pricing for a myriad of SaaS-based products.

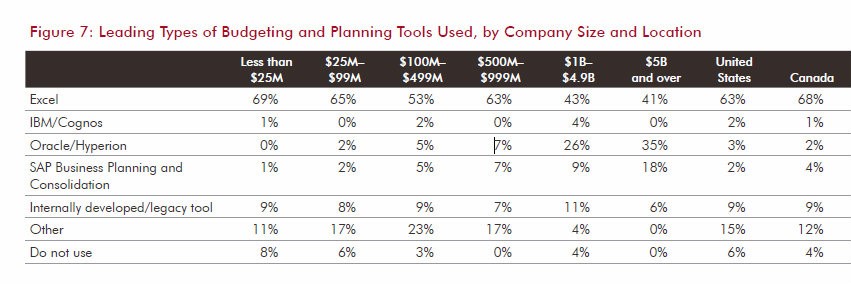

A survey in 2018 identified that the majority (63%) of U.S. organisations still use Excel as their primary budgeting and planning tool but that figure has fallen six points in a year. The report, 2018 Benchmarking the Accounting & Finance Function, a joint effort of Robert Half and the Financial Executives Research Foundation (FERF), shows how Excel is losing its supremacy as the go-to tool of choice for budgeting.

The report leads with an overview of technology trends impacting accounting and finance functions and says “digital transformation continues at warp speed in the world of accounting and finance.” These rapid changes transforming finance departments all over the world can be put down to data analytics, cloud-based computing, and artificial intelligence (AI) all converging to reduce manual processes and make accounting and finance functions more efficient.

Financial leaders now know that the key benefits to digitalizing processes include flexibility, scalability and cost savings. With automated business controls planning projects are not only easier and faster but allow for better control and produce higher quality information, so it’s of little surprise then that more businesses are inspired to search for digital solutions for their budgeting and planning processes, which have always traditionally been a time-consuming and costly exercise.

What’s driving the rapid uptake of digital budgeting?

By observing industry benchmarks, executives can learn how other businesses are using technology and thus update their own processes to keep pace with the changing landscape. Once a business has started digitizing a positive domino effect occurs in many accounting and finance functions. Leveraging of digital technology can create new business models, drive innovation and increase competitive advantage, this makes other teams take notice and search for more automation opportunities.

Excel is still the go-to tool for budgeting and planning, but more finance teams are embracing ERP and cloud-based solutions with similar capabilities, and as a result, fewer firms now identify Excel as their top tool.

Image source - 2018 Benchmarking the Accounting & Finance Function report

Cloud adoption

The benefits of cloud use in accounting and finance departments now outweigh entrenched reservations about cloud security concerns. Slow, complex and costly legacy systems are being gradually phased out with digital cloud solutions and these solutions are the best option for resource-strapped teams.

The 2018 Benchmarking the Accounting & Finance Function report, reveals that more than half (55 %) of U.S. respondents are using some or only cloud technology in their accounting and finance functions, and 20% plan to do so in the future. Only one-quarter of U.S. financial executives said they have no plans to adopt the technology, down from 28% last year.

How companies are automating budgeting and forecasting processes

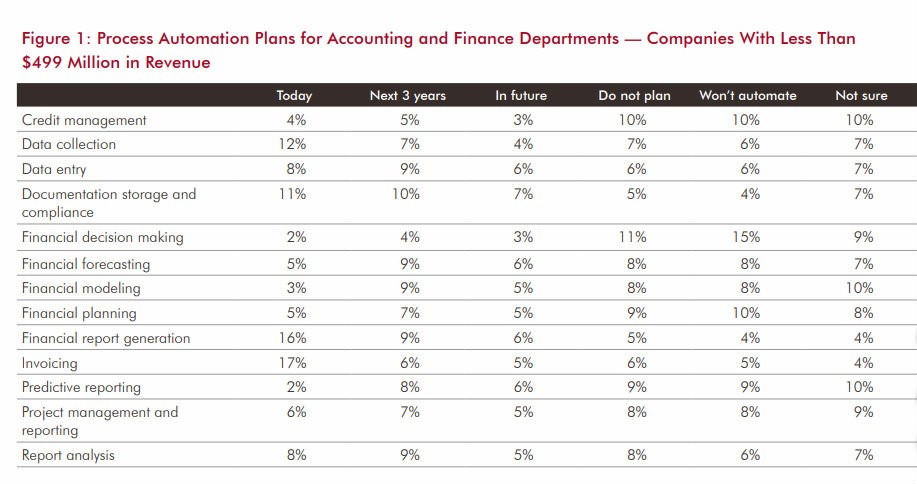

Most organisations are still wrestling with multiple spreadsheet environments to address financial and operational reporting. Budgeting, planning and forecasting remain siloed and unconnected across many businesses and reliant again on spreadsheets or legacy systems.

Forward-thinking finance chiefs need to be cautious and thorough in their search for the right technology. First of all, they must define the business case and ensure there are enough resources for it. Define your business needs first, then, get the right technology. Getting the right fit for the business can take time and requires some extensive research. Choosing the wrong solution with the wrong fit for the business could cost be detrimental to the business and swallow a lot of investment.

Image source - 2018 Benchmarking the Accounting & Finance Function report

In your search for budgeting, forecasting and reporting solutions consider the primary market-leading solutions and the ones that can consolidate planning and reporting in a single system.

Mercur Business Control

Mercur Solutions has developed and delivered advanced and high-quality solutions for planning, reporting and analysis for over 40 years. Its’ performance management and business intelligence software can support different technical environments and very diverse requirements for customers across the globe.

One such customer is Hellmann Worldwide Logistics. Mercur has partnered with Hellmann for more than two decades to plan and monitor its performance around the world. As a leading global supplier of logistics services, Hellmann has increasing demands for supporting larger data volumes. Mercur Business Control provides a comprehensive budgeting, reporting and analysis tool to support the companies 600 users across 56 countries.

Mercur Business Control is the main tool for Hellmann’s budgeting, reporting and analysis and it enables a central controlling department to create an accurate picture of the company’s business performance on all levels.